If you run a business, you know how important it is to have a significant return on investment (ROI). After all, what’s the point of investing money into a project if you don’t expect to get more money out of it?

To better understand how well your business is doing, you need to determine what a good ROI looks like. But how can you do that?

This is where the LTV:CAC ratio comes in.

In this article, we’ll take a look at what the LTV:CAC ratio is, why is it so important, and when you need to improve it.

What is the LTV:CAC ratio?

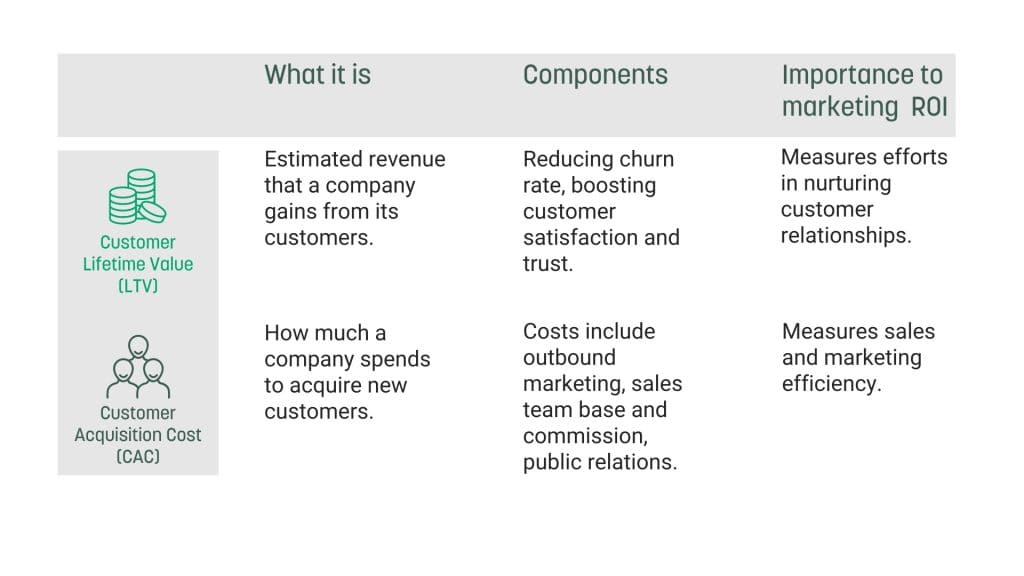

First, let’s break down the two components.

The Customer Lifetime Value (LTV) is used to forecast the revenue a customer will generate over the course of their interactions with your company. Customers who spend the most over the longest time frame will have the highest LTVs.

This metric can be calculated in different ways:

LTV = ARPU (Average Revenue Per User) * Gross Margin * Average duration of customer contracts

Or

LTV = ARPU / Churn Rate

The Customer Acquisition Cost (CAC) refers to the total your company spends on sales and marketing to acquire a new customer within a specific timeframe.

It is very useful when it comes to understanding the true profitability of your business since it compares the amount of money you’re spending on gaining customers to the number of customers that actually sign up.

To calculate it, you can use the following formula:

CAC = the total cost of acquiring customers / the total customers acquired over a given period

So, now that you know what each metric means, we can discuss the LTV:CAC ratio.

This ratio measures the relationship between the lifetime value of a customer and the cost of acquiring that customer. It is a signal of profitability and an essential metric for your business as it allows you to manage your marketing expenses, customer retention, cash flow and customer churn.

How to calculate your LTV:CAC ratio?

To calculate your LTV:CAC ratio, you divide your average customer lifetime value by the customer acquisition cost.

For example: £3000 LTV / £1000 CAC = £3.

In this case, your LTV:CAC ratio would be 3:1.

You can also use it to measure the Return on Investment (ROI) for each dollar your brand spends to acquire a new customer. In our example, each dollar invested would bring £3 in profitability.

Why is LTV:CAC ratio important?

Calculating your LTV:CAC ratio is a great way to see if your company is positioned for sustainable growth.

By calculating your LTV:CAC ratio, you can determine how much or how little you should spend on marketing and/or sales to maximise your growth and stay ahead of the competition. This way, you can be sure you’re making the wisest investments in terms of both time and money.

Knowing exactly what your customers are worth to your business enables you to focus your efforts where they will be most appreciated, and therefore most lucrative. It also helps you improve your strategies so that you can lower the overall CAC, thus increasing profits.

What is a good LTV:CAC ratio?

Ideally, LTV:CAC ratio should be 3:1, which means you should make 3x of what you would spend in acquiring customers. More or less than a ratio of 3:1 can be seen as a “bad” ratio and needs some optimisation.

1:1 ratio can mean you are either having a too high marketing spend for each new customer or have pricing that’s too low. You might also want to look at the retention rate of your existing customer base and average order value.

5:1 ratio can mean you may be spending too little and could be improving your revenue growth by investing more in your marketing strategies and marketing campaigns.

Finding the right balance will be the key to your success.

How to improve your LTV:CAC ratio?

These few strategies can go a long way in improving your company’s LTV:CAC ratio:

1. Be strategic on whom to sell to

Target your sales efforts to the relevant areas of value for each individual. Your potential customers might require a differentiated approach to demonstrate the value of your product.

2. Cut unnecessary costs

Reduce sales and marketing expenses through customer segmentation and sales specialisation to concentrate efforts on high-value customer segments. Improved efforts at lead generation can also make more effective use of marketing spending.

3. Focus on your customers’ needs

Focusing on improving the customer experience will also reduce churn and improve LTV via higher retention rates. It also leads to increased gross profit margins by decreasing cost and time of implementation. The key is strategic customer segmentation and providing high-touch customer support. Knowing the value of your product and how it fits your customer’s needs is important to this effort.

Bottom line

If you want to better understand how much money you gain from each of the customers added, but also understand the opportunities for improvement, then this metric might be what you need.

The next time you find yourself examining your marketing impact, ask your team whether they have checked the LTV:CAC ratio lately. It will surely be worth your while.

Want to receive updates from us?

Get the latest insights on AI, data and technology straight to your inbox.

No noise, just smart thinking from the team at Braidr.